The phrase “get your affairs in order” probably makes you think of death, but that’s actually not when or why most people do it.

Death is a common motivator, and people often become motivated to organize everything when they lose a friend or family member, but most people think about ordering their affairs when crossing big milestones in their lives. Moments such as getting married or divorced, having children, taking a big vacation, or moving to a different state.

This article is written to help you get your affairs in order — that way if an emergency arises or if you pass away, you don’t leave a mess behind for your family and loved ones.

If getting organized seems like a daunting task, imagine what it will be like for your family if you don’t! It’s worth taking the time to spare your family the legal headaches, give them space for their grief, and simplify their lives — trust us.

What Does It Mean to Get My Affairs in Order?

To get your affairs in order means legally arranging your financial accounts, property, and your personal and medical information in such a way that family members and trusted people in your life can handle your estate and affairs with as little inconvenience as possible when you pass away or become incapacitated.

It can be an overwhelming task, but if you break it up into parts you can easily get it done in a few hours.

Why Should I Get My Affairs in Order?

There are two great reasons to get your affairs in order. The first is for you and the other is for your family.

1. You Will Feel Relieved and Secure

First, it feels good. Really, it does. Knowing you have everything organized, including instructions, checklists, and your important papers all together in one easy-to-find place will reduce your anxiety next time you go on vacation. There’s no “what if” syndrome — the organization brings a sense of order and satisfaction.

2. You Will Save Your Family an Immense Amount of Time

Second, getting your affairs in order is a responsible and kind thing to do. If you don’t organize everything, then your family will have to do it for you after you pass away. The more you do now, the less they have to do later.

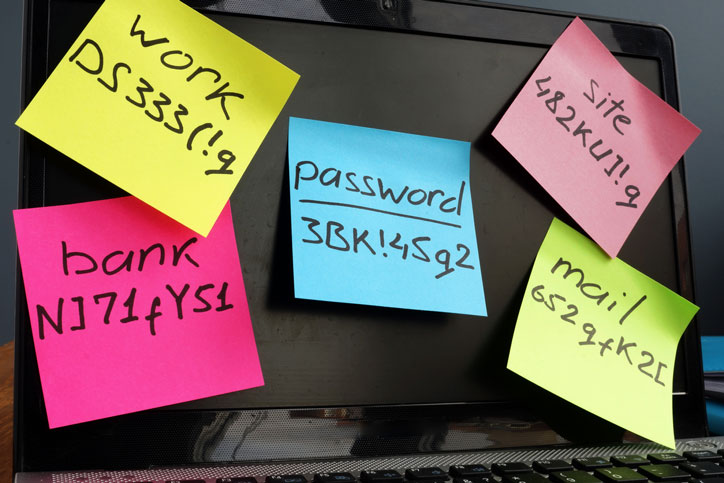

Handling the affairs of a deceased parent or other family member can be daunting. Paying the expense of a house or condo is time-consuming. Identifying little things like accounts, passwords, and expenses can be a huge source of frustration.

If it takes you a few hours to organize your paperwork and information, it will take a few weeks for your family to get it done. The hours you spend will save them days of frustration, avoid making them take time off from work, and relieve some of the stress and worry that accompanies these hard situations.

Before You Get Started

We have helped thousands of people get their affairs in order and have worked in estate planning for over 25 years. Here are a few tips picked up over those years to think about before you begin.

There is a long list of tasks you need to do, so pace yourself.

Depending on the number of accounts and properties you have, it will take at least a few hours to get it all done. But you don’t need to do it all at once! We recommend you spend no more than an hour at a time over the course of a few weeks. The best time to get started is when you do your Will or Trust, but if you already have those documents, then there is no better time than the present.

Try to have one central place for the types of documents and information your family will need when you pass away.

Many people have one file or cabinet drawer dedicated to dealing with an emergency. Not only will this save your family time if they have to handle your affairs, but it will also keep you organized. If you don’t already have a designated area, your first step is to pick a single space where you are going to keep everything.

Start today, if you can.

The biggest challenge is getting started. Nobody likes to think of their own demise, but remember, you don’t need to organize everything perfectly all at once. Maybe today you identify your important papers and next weekend you make a list of your assets. Then another day you make a list of your online accounts.

Divide and conquer! Tax time is a good time to make progress because you have to put a lot of related information together anyway. If you have a financial advisor, you can always ask him or her for help. The accountability alone is worth it.

6 Steps to Getting Your Affairs in Order

Step 1: Consider Hiring an Estate Planning Lawyer

You need estate planning documents if you want to get your affairs in order. At the very least a financial and medical power of attorney and a Last Will. Maybe a Revocable Trust, too. We recommend hiring an estate lawyer to prepare them for you.

There are many online and DIY options that do a good job with the basics, but every family and estate has unique characteristics, personalities, and needs. Hiring an experienced lawyer to put together a complete package for your situation is the only way you will really get the peace of mind you and your family deserve.

Asking Around

You’ll want to shop around. If you have a larger estate or complicated family situation, you should be prepared to pay more and retain an experienced lawyer – it is worth it. If you have average means and a simple family situation, then using a less experienced attorney is fine.

Most estate lawyers will be happy to do a courtesy phone call for 10 minutes. Do at least a couple of them. Have a list of your assets and approximate values ready. You’ll have to do a little financial undressing. Ask if a Revocable Trust is right for you, and why. The answer may be revealing — the lawyer should give you all the pros and cons. Sometimes having a more expensive plan with a trust is a no-brainer, but other times you really don’t need it.

Process and Costs

A typical estate planning engagement will take 2 – 4 weeks, and a lot of that depends upon you.

Ask about the lawyer’s process and about fees. Most attorneys will need to meet or conference with you twice. The lawyer you meet with might not be the lawyer that does the work, so ask about that as well. Be sure to review a draft of the documents before you go to the office to sign everything. A complete estate plan can cost between $900 and $2,500, more if you own a business or have a lot of real estate.

If you already have estate planning documents, it is still worth having a consultation with a lawyer if it’s been more than a few years since you did the documents. Hourly rates range for $175 – $350. If you prepare questions, have a list of your assets, and bring a copy of your beneficiary forms and deeds for real estate, you can get a lot out of an hour consultation.

Step 2: Pick Your “Fiduciaries”

Your “fiduciaries” are the people you choose to handle your financial and medical affairs if you are not able. Sometimes this person is called your “Executor,” “Trustee,” “Power of Attorney,” or “Patient Advocate.” The selection of your fiduciaries, including backups, is easily the most important estate planning decision you will make.

You should give a lot of thought to choosing someone whose values are consistent with your own. Also, consider naming a backup in case your first choice can’t do it — that happens all the time. Be sure to ask your primary person if they are open to helping if anything happens to you. After you have organized your documents and information, you should let your executor or power of attorney know about it, including where you keep everything.

An experienced estate lawyer can be a big help with your choice of fiduciary. Between your knowledge of your family members and the lawyer’s knowledge of what he or she may need to do, you will come out with the best possible arrangement with experienced advice.

Step 3: Update Your Beneficiary Forms

Most people don’t think of beneficiary forms for their retirement accounts or life insurance as an estate planning document, but they are “governing instruments” that direct where those accounts will go when you die. Beneficiary designation forms should be consistent with the terms of your will or trust.

Keeping your forms updated as things in your life change is important to be sure your plan is carried out the way you want and to minimize taxes. Each beneficiary designation must fit into your big picture. Be sure you have a copy of all your beneficiary forms in one place so you may confirm the status and update the forms when necessary. Your estate lawyer can confirm you have the primary and contingent beneficiaries set up so things are handled the way you want if the unexpected happens.

Step 4: Update the Deeds for Your Real Estate

Real estate can be transferred by signing a deed. The type of deed you need depends on a number of factors. While preparing a deed may seem simple, and in some cases it is, if you mishandle it there may be negative tax consequences and you could also lose your title insurance. Additionally, without the right type of deed there may be delays and additional costs when you try to sell or refinance the property.

You have the option of recording the Deed or keeping it in your files. In some cases recording the deed can be the better choice, but in other cases it may be a mistake. A good estate planning attorney can ensure you get it right.

Step 5: Organize Important Documents and Information

Gather all of your important documents and store them in a safe place, both digitally and physically. Besides your Will, Trust, Beneficiary Forms, and Deeds, you’ll want to gather and organize these documents:

- Life insurance policies

- Medical insurance card

- Birth certificate

- Social security card

- Marriage certificate

- Military records

- Copy of your driver’s license

- Password list for all relevant online accounts

- Vaccination records

- Location of important keys and combos

- Copy of your passport

- Citizenship papers/work permit

- Adoption papers

- Christmas card list

- Divorce decree or prenuptial agreement

- Tax returns

You will also want to maintain lists of financial and personal information that your power of attorney and executor may need. That information includes:

- Contacts of people who are involved with your money and property (accountant, financial advisor, etc.).

- List of your assets, property, and financial accounts, including things to know about each item/account.

- Debts and expenses, and how you pay them (via auto bill pay, writing a check, or charging it to a credit card).

- Contacts for medical matters like your doctors and dentist,

- Health insurance and a list of medicines can be handy

Step 6: Keep Your Affairs in Order

Getting everything in order takes time. But the good news is you don’t have to do it all at once. Make a habit annually of going through your lists and “emergency drawer.” Many people do it during tax time.

Getting your affairs in order is a process and project that you can chip away at over a few months or even a couple years. But you need to get started and following the steps above is a great way of making that happen.

Keeping everything in order is even easier once you have it all in one place. But, you have to give it attention and time every year.

Common Questions About Getting Your Affairs in Order

The steps above are the basics, but there’s a lot of nuance in this process — especially when your estate gets more complicated. Here are a few common questions and answers people have when getting their affairs in order.

Where Should I Store My Estate Documents?

In Your Bedroom

You should keep the originals in a safe place in your home, but somewhere accessible in case of an emergency. In the back of your bedroom closet or under the bed might sound silly, but unless your bedroom is adjacent to the kitchen or a furnace, it is the ideal place.

Don’t put them in a safe deposit box because they can be difficult to access, and giving copies to family is usually a bad idea — people tend to misplace them over time and, more importantly, if things change over the years you may not be able to tactfully get the copies back.

On Your Computer

If you keep a copy on your laptop or desktop computer, be sure it is secure and that your family can get the password. It may be tempting and easy to email a digital copy to your family, but problems can (and do) arise later if you make changes to the document. If there are old documents “floating around”, they can cause confusion if you’re not able to destroy them when you update your estate plan later on.

We made LawSafe® for this exact reason: to have an encrypted place for all of your relevant estate documents that you can easily update and store instructions/specific account permissions in the event of your death.

With Your Lawyer

Your lawyer should also keep a digital copy, and go ahead and give the name and contact information of your lawyer to your family, too. Your estate lawyer can act as a gatekeeper of sorts for the documents and any information you share with him or her during the estate engagement.

Most estate lawyers routinely and without any additional charge will hold onto a copy and make them available if they are contacted by a family member who proves they need the documents.

What Else Should I Do to Maintain My Financial Accounts and Real Estate?

Keep Lists

Be sure to leave notes and instructions along with your lists of important financial and personal information. The more your family knows about your affairs the better.

You don’t need to include values and account numbers for your financial items, just information about where they are and how to get access when the time comes.

Think about everyone who helps you with your money and property, including anyone else who your family might need to know to help them. Keep recent statements in an accessible file along with your tax returns.

Handling real estate can be the single most challenging item for a power of attorney or executor. Include a list of people who help take care of your real estate, like lawn maintenance or snow removal, the name and telephone number of a housekeeper or handyman. If you are not able to take care of your property, having the contact information for these people will make the process for your family a lot less frustrating.

Use Autopay

Knowing how things are paid can be a huge source of relief for your executor. The more items that are automatically paid from a bank account or credit card, the better. Just be sure those bank and credit card statements are readily available so they can be reviewed if you’re not around. If you pay certain expenses by check, make a special note of them.

Due dates for things like real estate taxes should be noted on your checklist, along with due dates for auto and property insurance, life insurance premium payments and other sensitive bills that might have immediate negative consequences if not paid timely.

What About My “Stuff”?

Financially or emotionally valuable personal property can get tricky. You should write out a list of what and to whom you want to give each item when you pass.

Be sure to sign and date the list. If you can, give certain items to your family during your life — doing so can be easier for everyone.

If you are planning on leaving important items at death, consider talking with the family members who might want them. You can avoid conflict and aggravation by sorting out who gets what during your lifetime, decreasing the chance of arguments breaking out after you’re gone.

What Should I Do About My Online Accounts?

Most of us have social media and other online accounts and making sure your family has convenient access to them after death is important.

This is where your list of accounts comes in. Remember to include where you keep your “Christmas Card List,” copies of family and other photos, your Facebook or other online posting accounts, Paypal and/or Venmo account information.

Along with a list of these digital assets you should consider leaving a list of passwords if you don’t use an online password manager.

What About My Medical Information?

You’ll want to leave a list of your doctors and medications. If you have a medical MyChart.com account, be sure to make a note of it and how to access that information.

A copy of your medical insurance card(s) should also be placed with your other important documents. Writing out a list of allergies can also be helpful in case you’re hospitalized and are not able to communicate those matters to your doctors in an emergency.

Should I Plan My Funeral?

It can be a source of relief if you have your funeral arrangements sorted out ahead of time, so we recommend thinking it through.

Make Notes About Any Details of the Service

If you want a service or not, be clear and write out those wishes. If you want your body or remains disposed of in a particular manner, you’ll want to write that down and, again, name one or more people in whom you have confidence they will carry out those wishes.

If you hire an estate lawyer to help you with your documents, he or she will be sure you have the details typed up for the appropriate person to see and act upon.

Don’t Pay For Your Funeral Ahead of Time

Unless you are well into your 70’s or 80’s or have a terminal diagnosis, we don’t recommend prepaying the funeral or cremation. Generally, the closer you are to passing away the more financially attractive you will find funeral and cremation contracts.

Organ and Cadaver Donations

You should specify whether or not you want to donate your organs, or if you want your entire body “donated to science.”

If you are serious about donating your body to science you should specify in writing to which medical school your body will be donated. We don’t recommend the school be notified in advance — just designate one or more people to be sure your wishes are carried out. And be sure your family knows your wishes for cadaver donation. If it comes as a surprise, your family may object and the medical school will not take your body.

Make Sure Your Family Has Your VA Number for Funeral Benefits

If you were in the military, and you want a military service, be sure your VA Number is written down somewhere accessible and remember you are entitled to certain funeral benefits.

Take the Stress Out of Getting Your Affairs in Order

There is a lot to think about and do, but LawSafe® can make getting your affairs in order much easier. LawSafe® Systems is an online portal that costs as little as $17/year and allows you to store all your documents and information in case of an emergency and for when you die.

Plus, organizing your affairs is just the beginning — keeping them in order is the hard part. LawSafe® solves that with annual reminders and the ability to grant limited access to your “Circle of Trust®”.

It also lets you designate an independent gatekeeper who will only give over full access to everything if it is proven that you are incapacitated or have died. This ensures you have privacy until the last moment.

Save time, don’t miss anything, share your documents and information at the right time with the right people, and get some peace of mind.